This Wall Street Journal graphic showed that the damage was done in these two names by 10:30 Friday morning.

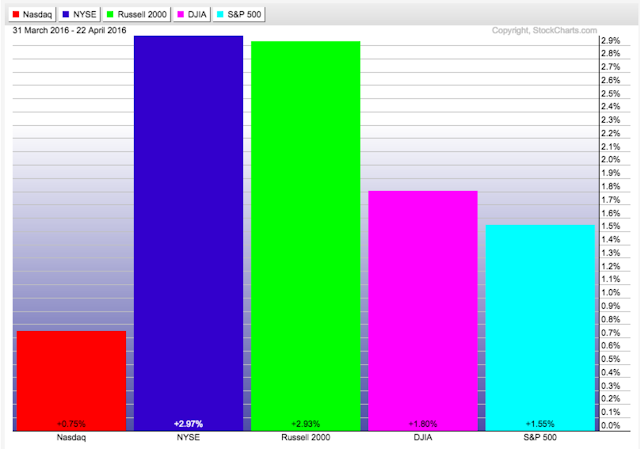

Even with Friday's weakness, the NASDAQ is still up 75 bps in April but remains down 2% in 2016. Meanwhile, the other major domestic indexes sit in positive territory for both the month and year to date with one more trading week left in historically strong April.

APRIL

2016 YTD

Prior to Friday's weakness, we had tweeted out a chart this week of what appeared to show low volatility stocks slowing down relative to high beta stocks. We noted a potential trendline breakdown that was suggestive of high beta looking set to outperform. We're going to keep an eye on this relationship as it will be telling in terms of gauging this environment particularly as we work through earnings. However, Friday was certainly not an endorsement of high beta taking over.

One thing to note in the tech sector, per Morningstar, is that through the end of March investors had pulled $4.5 billion out of tech focused mutual funds and ETFs. This after three straight years of inflows.

We're at an interesting point in time right, we're at the tail end of the most favorable seasonal period, we're in the thick of earnings season and, as Steve Deppe (@SJD10304 on Twitter) notes, we have important indexes reaching critical junctures. Deppe notes that the monthly chart of the Russell 2000 looks primed to re-take its 12 & 20-month movings averages. This would be a clear sign of "risk-on" and favor further highs in equity markets.

Have a great week.