The market experienced a 10% sell off from the July highs to the October lows. Since the lows in late October, the equity markets have witnessed a massive rally off the bottom. What changed and what may be driving this shift in sentiment? We'll dig into the recent Bank of America global fund manager survey to identify any patterns along with some statistical analysis.

The key takeaways from the monthly BofA global fund manager survey (FMS) can be summed up in a few sentences. Investors expect a soft landing with lower rates next year as they think the Fed is done raising rates. Cash is being put to work as investors are overweight bonds and are now overweight equities. Below is a summary of the report and then we dig into some individual stats.

BofA November Global Fund Manager Survey

The Nut: Fund Manager Survey (FMS) investors remain cautious on macro but turn bullish on interest rates; investor playbook for 2024 is soft landing, lower rates, weaker US$, large cap tech and pharma bull continues, avoid China and leverage; investors cut cash from 5.3% to 4.7% (2-year low), move to biggest bond overweight since Mar'09, flip to 1st equity overweight since Apr'22.

On Macro: investors expect weaker global growth (net -57%) but 74% predict soft or no landing at all (21% say hard landing); "short leverage" theme…CIOs tell CEOs to improve balance sheet (52%) rather than increase capex (21%) or stock buybacks (18%).

On Policy: 76% say Fed hiking cycle over, 80% expect lower short rates (most since Nov'08), 61% expect lower bond yields (Chart 1, most on record) despite 2nd highest ever saying fiscal policy too stimulative; contrarians note just 6% see higher CPI in 2024.

On Crowds, Regions & Sectors: Nov FMS shows long positions in/rotation to bonds, tech (2-year high), REITs, US & Japan stocks (5½-year high), and rotation from/short positions in cash, materials (3½-year low), industrials, banks, UK/Eurozone stocks; most crowded trades: long Big Tech 38%, short China stocks 22%, long T-bills 11%.

FMS Contrarian Trades: long cash, short US growth stocks & Japan equities in surprise "hard landing"; long cash, US$, commodities if "no landing"/higher rates the '24 surprise; most contrarian trade of 2024 is "long leverage, short quality".

The 10 year has broken the uptrend from the May lows. Is this what markets are cheering?

The big change in the November FMS was not the macro outlook, but rather the conviction in lower inflation, rates, and yields as evidenced by the 3rd largest overweight in bonds in the last two decades. (Only in March 20009 and December 2008 were investors more overweight bonds.)

Investors are much more optimistic as equity allocation is overweight for the 1st time since April 2022.

The soft landing narrative is driving the optimism.

The conviction of "peak Fed" is now the strongest since FMS investors began providing their view on timing of end of rate hiking cycle. Only 6% of investors expect higher short-term rates.

While worries about inflation and central banks are easing. Meanwhile, geopolitical risk has jumped to the top of the tail risk.

The magnificent 7 drives the most crowded trade for the last 3 months.

Yet they expect bonds to be the best performing asset class in 2024.

One month ago the CNN fear and greed index stood around extreme fear. Now it is back to a more normal reading. Sentiment has shifted fast from extremely bearish to neutral as the markets have rallied.

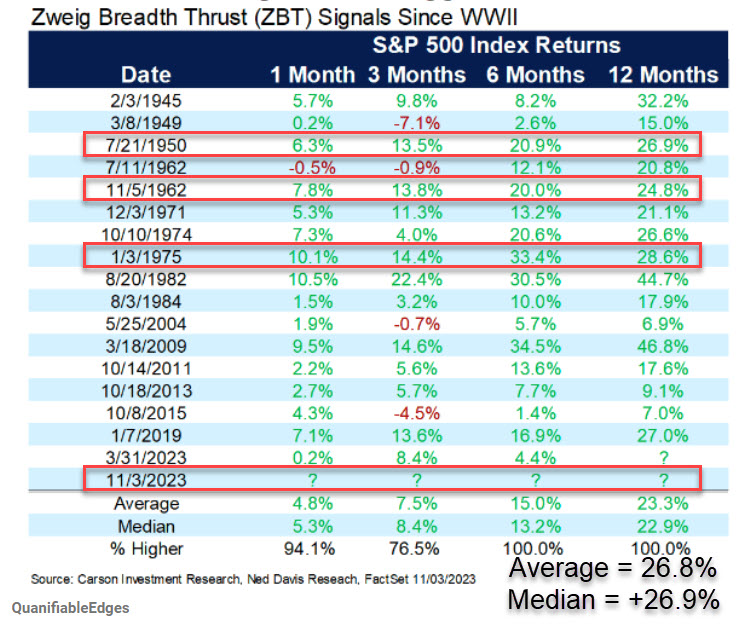

The one thing this market has been missing is a confirmation of breadth as more than the Magnificent 7 rally. Well we are witnessing that in real time as Jay Kaeppel shows we had the second Zweig Breadth Thrust within 18 months. The sample size is small but very favorable to higher returns.

We are finally getting participation from beaten down small caps. They are up more than the S&P and Dow month to date.

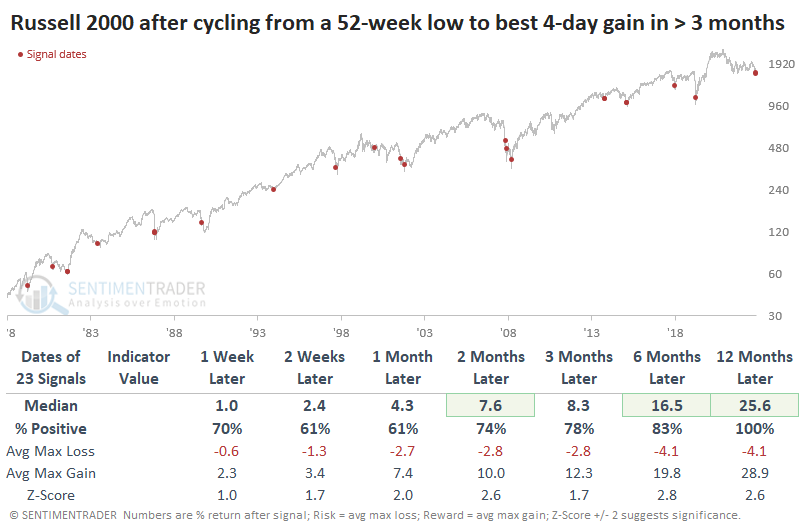

Jason Goepfert provides some context on the small cap rally off the lows.

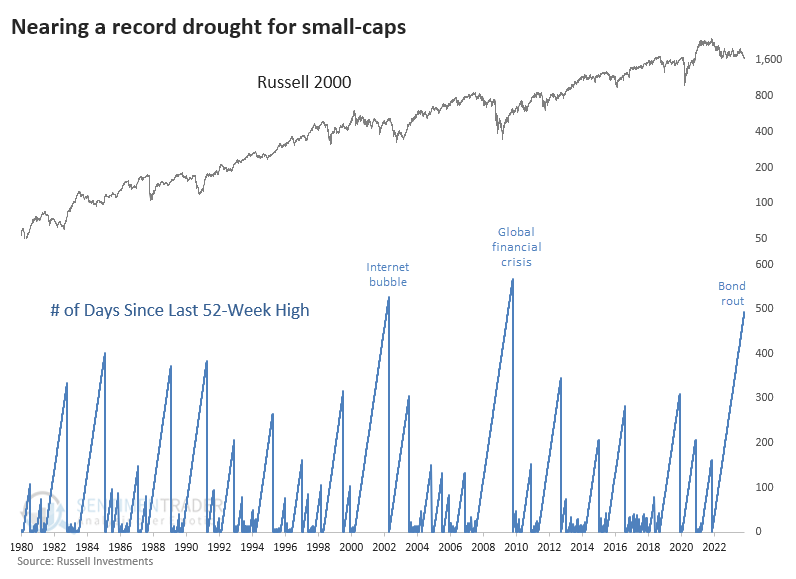

The current price thrust in small caps is coming off a historic drought as the Russell 2000 is nearing 500 days since it last made a new 52-week high.

The current market is setting up for a potential 4th quarter rally and then some. We are coming off a 10% correction in the markets that saw sentiment hit fearful levels coupled with massive oversold readings. If yields can moderate and stay below October highs, the current price and breadth thrusts off the October lows have the potential to set up a bull market run. As always we'll stay flexible and vigilant with regards to risk management.