We remain in a favorably bullish period for the markets (Nov-April) and December is one of the best months of the year with a 1.50% average gain while finishing higher almost 74% of the time.

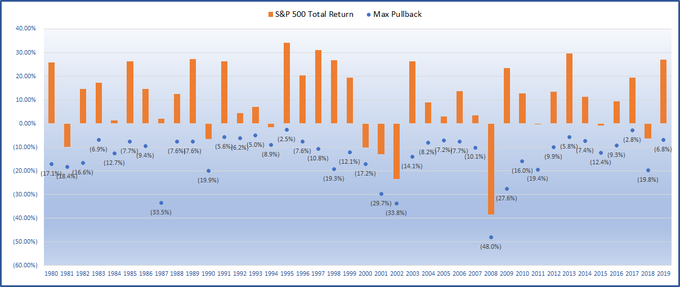

Not only has 2019 been a great year for the equity markets it has also been one of the least volatile. According to Ryan Detrick, "the S&P 500 has pulled back 6.8% from peak to trough in 2019. This is actually one of the smallest pullbacks we've seen in recent memory."

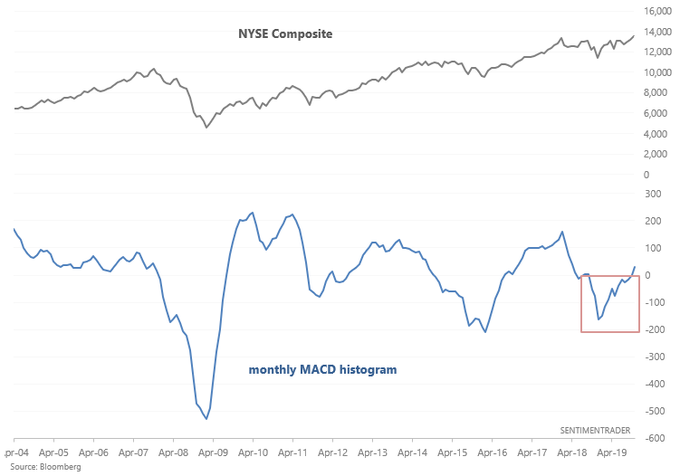

A great study from Sentiment trader trader shows the MACD indicator setting up bullish for stocks the next year. Monthly MACD's are now turning positive for the Dow and NYSE Composite for the first time in >1 year. This is bullish for stocks on a longer term basis. When this happened in the past to the NYSE Composite, stocks went up 100% of the time 6-12 months later.

As we embark on a new decade we also enter the 4th year of the presidential cycle. Nautilus Cap does great cycle work and below shows the S&P seasonal composite for the forth year of the election cycle which shows first half volatility follow by a resumption of the trend and strong close to the year.

On thing that has been missing from this market is complete market participation. As equity indices hit new highs the amount of stocks hitting 52 week-highs is non existent. In fact, more stocks are hitting new 52-week lows. Meanwhile the A/D line supports the trend which is encouraging. This all amounts to mixed signals from participation. We can see from the chart below the A/D line in yellow is confirming the strength in the NYSE Composite while new highs total just 19 and are strongly outnumbered by 106 new lows.

If breadth is to confirm the strength in equity market it will need participation from small caps. They have trailed the larger cap indices all year but are starting to gain traction. Even though the Russell 2k remains below all-time highs posted in 2018 it did make a new 52-week high recently. If you are buying small caps you are making a bullish bet on domestic growth in 2020. If the economy avoids a recession, which we think is likely, and the economy accelerates, small caps will be a good bet. Economic recoveries “tend to be the best phase for small-caps,” says Jill Carey Hall, an equity and quant strategist at Bank of America Merrill Lynch. “That’s one key reason we think we could be poised for a shift from large to small.” Small-cap outperformance is one of Bank of America’s biggest bullish predictions for 2020, strategists there said this past week.

When it comes to the economy, there is plenty of supporting data for growth to resume in 2020. There has been no earnings growth this year. According to FactSet, Q1 earnings were down 0.2%, Q2 earnings were down 0.4%, and Q3 earnings were down 2.2%. In fact, it will market the first time in 3 years of three straight quarters of year over year earnings declines since Q4 2015 through Q2 2016. Yet, equities are trading at all time highs. Why is that? Typically, equity prices are forward looking. The most recent jobs report just printed an unemployment rate of 3.5% which is a 50-year low coupled with a surge in jobs. With an accommodative Fed keeping interest rates low along with the good news for the US labor market in the November employment report could help validate the acceleration in the economy and earnings picture in 2020.

Something to keep an eye on and one the bears will point to is valuations. The US is one of the most expensive markets in the world based on P/E ratios. Alex Barrow from Macro Ops highlighted this in his recent weekly update. "Looking further out though into 2020 the SPX is going to be fighting some decently strong headwinds in the form of stretched valuations absent a visible driver of earnings growth. The below chart from Goldman Sachs shows the year-to-date rally has been almost entirely driven by valuations rerating higher. Over the longer-term, this is unsustainable — especially in the US where valuations are already high. Either earnings growth will need to pick up materially or equities will hit a wall."

These lofty valuations has Morgan Stanley lowering expectations for the next decade. Morgan Stanley expects the opposite for the next 10 years, as it sees valuations and returns reverting to their means. Translated, today’s high stock prices point to low future equity returns. Low bond yields necessarily mean lesser fixed-income returns. Moreover, taking on bigger risks also isn’t likely to pay off in bigger returns, the investment firm adds. “We estimate the average 60%/40% stock/bond portfolio will return only 4% to 5%, roughly half that of the past decade,” writes Lisa Shalett, chief investment officer at Morgan Stanley Wealth Management, in a client note.

As markets embark on new highs, lets check in on sentiment. Considering the recent strength from the October lows we would expect to see overheated levels. The CNN fear and greed index is flashing greed but is not overly excessive.

More supporting evidence that we could get a year end rally is the NAAIM Exposure Index which represents the average exposure to US Equity markets reported by active managers. It is elevated but still well below 2019 highs as markets sit at yearly highs.

In summary, if earnings and economic growth accelerates in 2020 higher valuations can be justified with the low interest rate envrionment. However, if said growth doesn't materialize the markets could be in for a volatile ride considering what they seem to be pricing in.