Today voters across the country go into the booth to cast their ballots for the midterm elections. We have a ton on statistical data on the markets during such events. Will the outcome change the direction of markets? We really don't know the answer but I would think based on betting odds it looks like we'll have a divided government. Below are the current odds for the house and senate from electionbettingodds.com.

A divided government is favorable for market returns and could be one of the reasons for the recent rally off the lows. Below shows the market returns under different leadership since 1977.

On top of that we are in a seasonably favorable time for market returns. Below is a study from Wayne Whaley. Since 1950 the S&P has never closed lower from the November of a midterm election year through April of a pre-election year while averaging 15% returns.

Ryan Detrick shows a similar outcome but also how weak markets tend to behave heading into a mid-term election. "The average midterm year since 1950 corrected 17.1% on average, the most out of the four-year presidential cycle. That’s the bad news, the good news is stocks gained 32.3% on average a year off those lows and have never been lower. Although we don’t know if October 12 is officially the low or not (but we think it very well could be), there could be a lot of opportunity for bulls over the coming year."

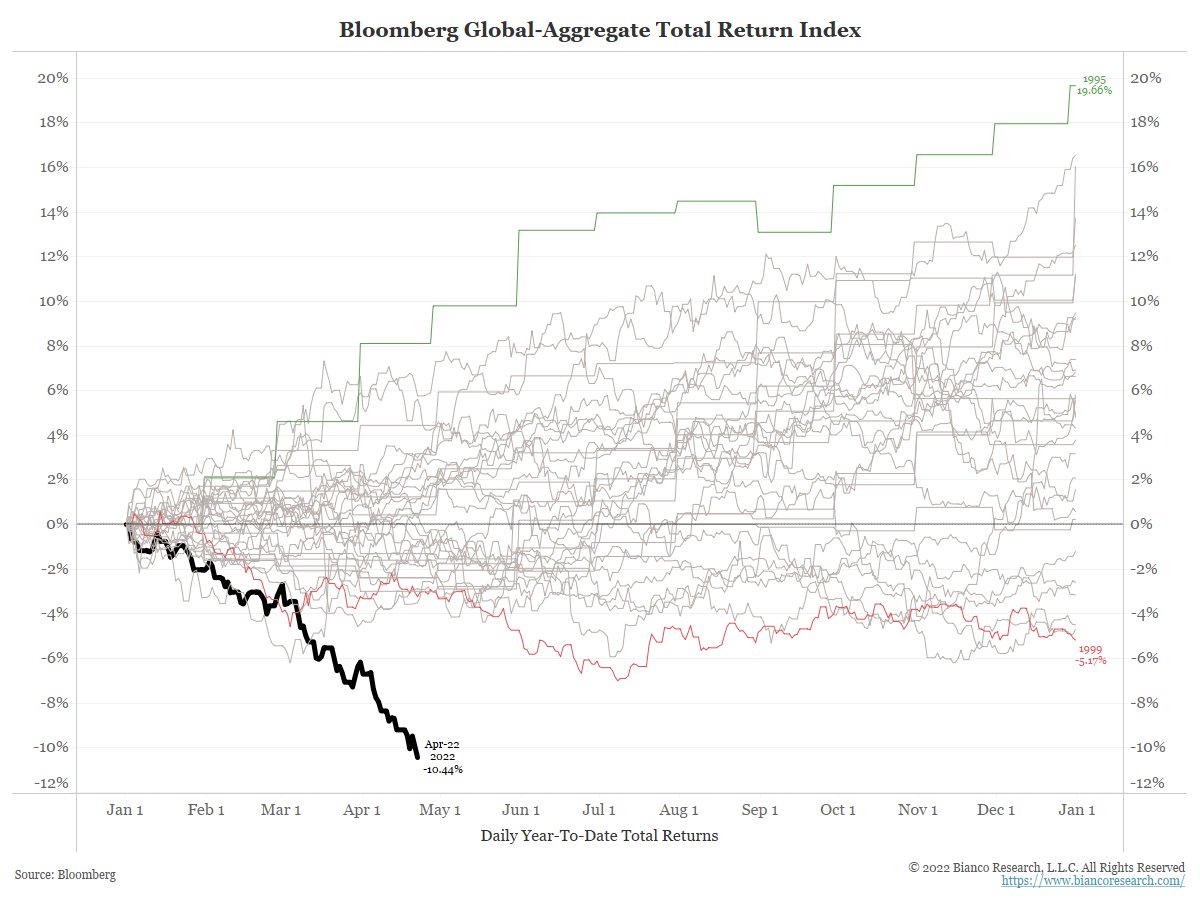

The statistical data certainly favors the bulls. However, what has us most concerned are the fundamentals and money flows. We have yet to see see numbers drastically cut or a panic in sentiment. The VIX continues to languish showing no real fear.

Prior market bottoms coincided with a capitulation in equity flows. We are not there yet.

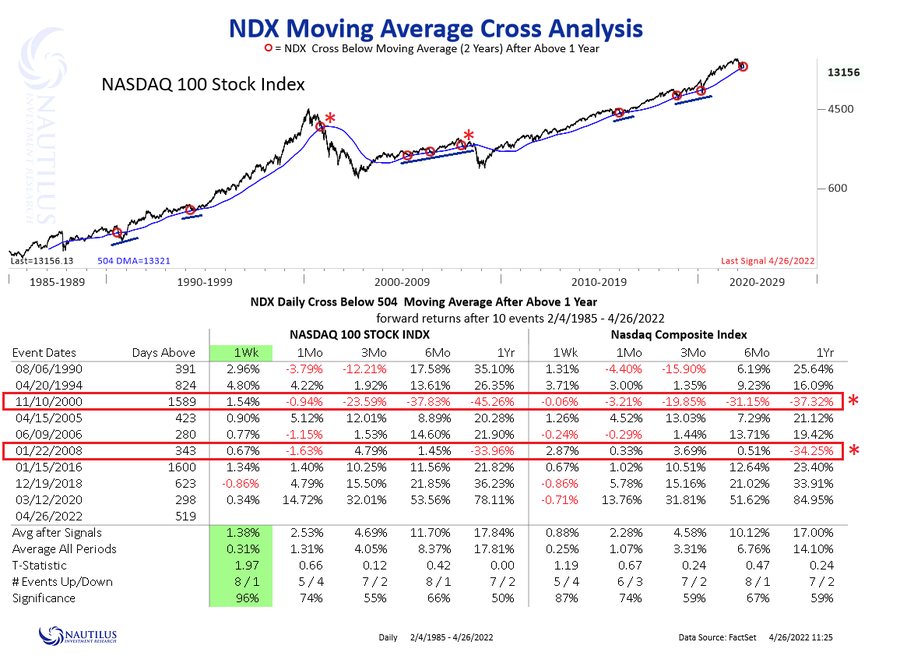

As of the end of October the average consensus among wall street analyst is for S&P earnings to grow 7.3% in 2023. However, some analyst are starting to cut their estimates as Goldman just did citing margin headwinds next year. BofA says S&P 500 earnings estimates for 2023 take complete U-turn as recession risks loom. What if we get a recession in 2023 and current estimates are way too high. Below is how much S&P earnings have retreated in each of the prior 11 US recessions.

If current 2023 estimates are $233 for S&P 500 what happens if they are drastically cut. Below are some scenarios depending on the magnitude of decline in 2023. With current year estimates now around $220 for 2022:

Decline EPS estimate

5% $209

10% $198

15% $187

20% $176

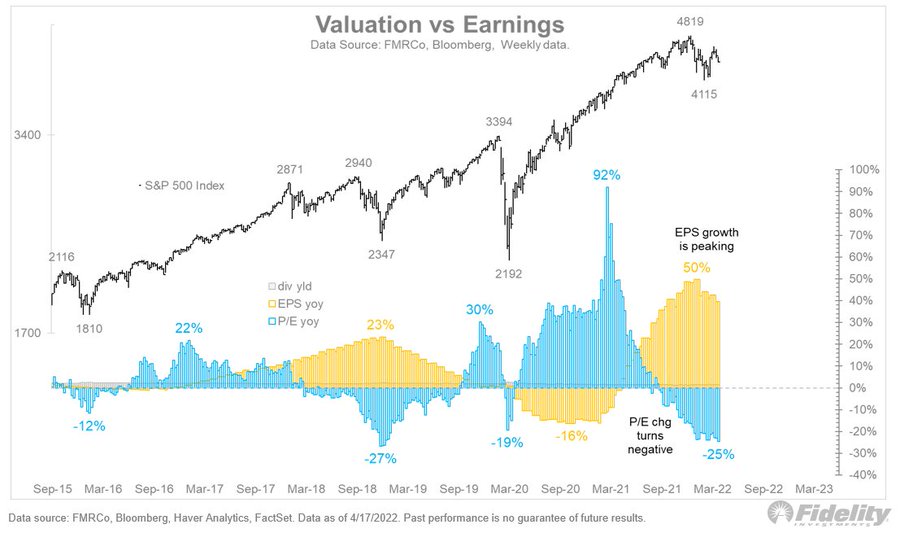

The forward 12-month P/E ratio for the S&P 500 is 16.1. This P/E ratio is below the 5-year average

(18.5) and below the 10-year average (17.1). If the S&P trades on a 10-year average for 17.1 times next year earnings based on lowered guidance where does that put the market?

Lastly, we continue to like the historical analog Jurrien Timmer at Fidelity has shown with the similarities to the 1946-49 market. "Then, as now, stock prices reflected the impact and then hangover of major fiscal/monetary impulse. If the analog holds, we could be in the process of another 15% counter-trend rally followed by another retest of lows."

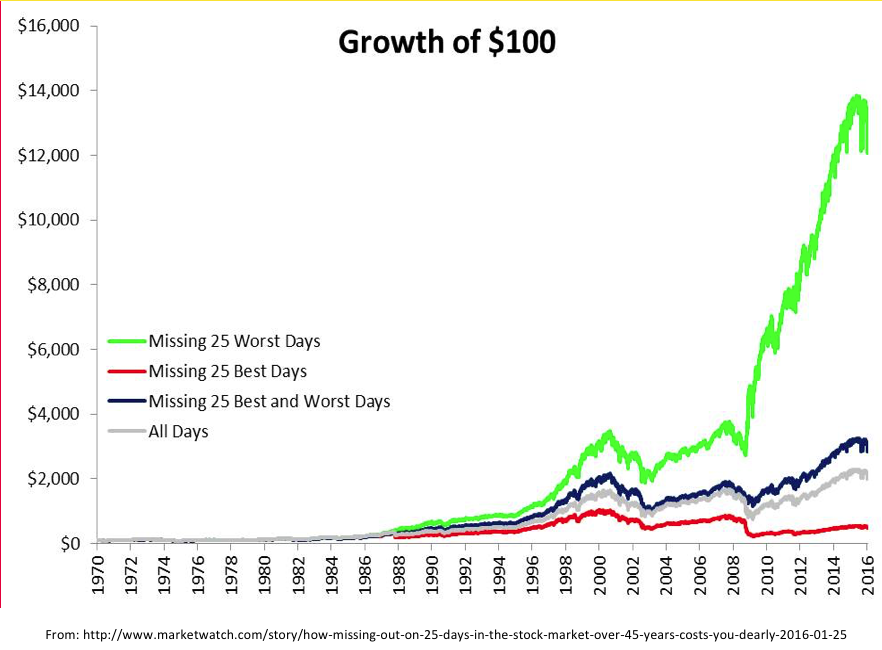

Once again there is something for both the bulls and bears. We try not to get too invested in one side or another and rather react to market trends and conditions. Our best guess is the next few months won't be an easy one either way with lots of confusion and choppy/volatile markets. The 1946-1949 analog would really frustrate the masses. Will be watching inflation data, rates, and the US dollar for any clues as these have been the driver of market returns the last year or so.