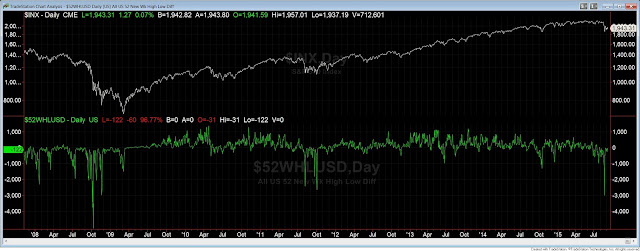

Stocks limped to the finish line yet again yesterday as the morning rally fizzled out in the afternoon hours and the S&P 500 ultimately closed in the red. The index has finished down in consecutive weeks now thus ending a span of 11 weeks in a row where it alternated between up and down. This type of weakness lines up well with what we should have anticipated from a seasonal perspective. According to Ryan Detrick, we currently sit smack in the middle of what's been the toughest stretch of weeks for the market over the last 10 years. The chart below shows how all weeks have done over the last 10 years. This week was week #38.

He says that if we dip a little further back into time, we see that things get a little hairy here for the market.

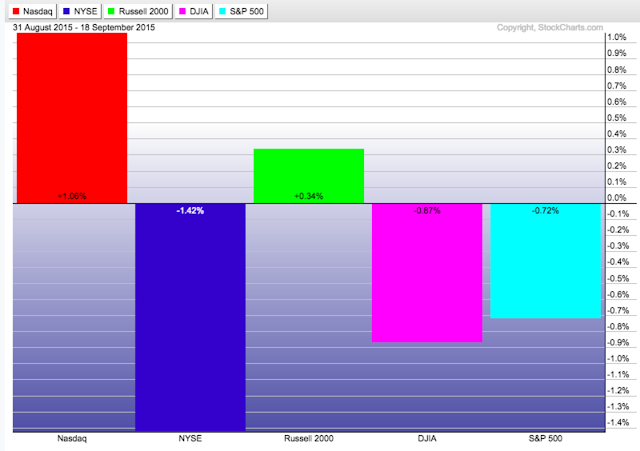

So while the market attempted to rally on multiple occasions this week, those efforts were rebuffed and the S&P finished down nearly 1.4%. The Nasdaq and Russell 2000 really lagged behind while the Dow held up fairly well considering the damage elsewhere.

The indexes remain down for September and appear to be on their way toward a 2nd straight losing month.

Nicholas Colas, Chief Market Strategist at Convergex offered up some insight this week on just how hard it's been to find returns so far in 2015. Presented below without interruption:

Summary: Netflix may be the only S&P 500

name that has doubled in 2015, but it’s not really the most important stock in

the index. First, there is Amazon, up 72% on the year. The online

retailer is the single reason the large cap Consumer Discretionary sector is up

on the year, for without AMZN’s 9% weighting that group would be down over 3%

instead of 3.4% higher. Then there is UnitedHealth, 20% higher on the year,

which is enough to make Health Care “Green on the screen” for 2015. Without it,

that sector would also be negative in 2015. Why all the fuss? Because

these are the only industry groups in the S&P 500 that are up for the year,

but it’s all because of those 2 stocks. Pull back the curtain on the entire set

of global capital markets, and the story is similarly dreary. Domestic

bonds? Down 1-5%. Precious metals? Down 3-4%. Developed

economy equities? Down 6%. Emerging economies? Down

17%. Fourth quarter 2015, which starts in 4 trading days, will be a

lively period as investors work out which of these asset classes will go

positive and which will sink further. In short, for many active investors

the year comes down to the next 3 months.

With less than 100

calendars days – and only 69 trading days – left in 2015 it’s not too early to

consider what kind of year we’ve had in capital markets. Simply put, it stinks. That

assessment isn’t just because of the -6.1% return for the S&P 500 year to

date. Rather, it is because essentially nothing has been working.

Consider:

·U.S. stocks, regardless of market cap range, are down on the

year. The S&P

400 Mid Caps are down 4.3%, and the 600 Small Cap Index is down the same

amount. The Russell 2000 is 5.3% lower.

·Developed economy equities – we’ll use the MSCI EAFE

(Europe, Asia, Far East) index here – are down 6.4% in dollar terms for 2015

YTD. Emerging

market equities, as measured by the MSCI Emerging Markets Index, are 17.4%

lower in dollar terms. Even the popular ‘Long Europe, short the euro’

trade is down by 3.4% in 2015.

· Fixed income assets, typically a hedge against lower equity

prices, are lower on the year. Long dated Treasuries, as measured by the Barclays

20+ Year T Bond Index, are down by 2.6% year-to-date. Domestic high grade

corporate bonds are 2.8% down in 2015, and high yield corporates are 5.7%

lower. International bond indices like the Barclays Global Treasury ex-US

index are 5.6% down on the year.

·Precious metals are down 2.7% for gold and 4.2% for

silver.

·If you want to find appreciating

assets, you have to go pretty far afield, or exhibit some unique insight and

bravery. For

example, old Ferraris, according to the Historic Automobile Group International

(HAGI), are up 8% year to date. Closer to home for equity markets, there

are 9 U.S. listed exchange traded funds that are up more than 30% on the year,

but all of them are highly volatile and most use daily resetting leverage to

achieve those returns. More generally, only 400 of the 1,773 ETFs listed

in the U.S. currently show a positive return.

If you focus on U.S.

equities, you might rightly point out that two industry sectors of the S&P

500 are up on the year: Health Care (+0.6%) and Consumer Discretionary (+3.5%). And that much is true, but

lest you think this is a sign of widespread enthusiasm for these groups,

consider that in each case it is only one stock that puts these industries in

the green for 2015. The math here:

·Amazon is up 72% year to date and has a 9% weighting in the

large cap S&P Consumer Discretionary Sector Index. That means it has added 6.5

percentage points to the group, almost double its actual performance. Put

another way, without Amazon the Consumer Discretionary sectors would be down 3%

in 2015, right in line with the performance of the other consumer group –

Staples – which is 3.0% lower for the year.

·In the case of that squeaker positive return for Health

Care, it is UnitedHealth that pushes it into the black for 2015. UNH is up 19.8% on the year and has

a 4.5% weighting in the S&P large cap Health Care index. That means it has

boosted the overall return for the group by 0.9% - again, enough to lift the

return to a positive number for the year.

· In short, Amazon and UNH are all

that separate the 10 industry sectors in the S&P 500 from showing a

negative return not just for the S&P 500, but for every major industry

classification.

If all this makes you

think that “Big Winners” have been thin on the ground in 2015, you are correct. Looking at the top performing

stocks thus far within the S&P 500, we find the following:

·Only one stock has

managed to double in 2015: Netflix (up 113% as of the close today).

·Only five stocks are up +50%. There is NFLX, of course,

Amazon (+72%), Cablevision (+64%), Activision (+ 58%) and Under Armour

(+51%).

·Only 10 stocks are up +40%. They are the names above, plus

Electronic Arts (+46%), Martin Marietta Materials (+45%), Starbucks (+42%),

Expedia (+42%) and Vulcan Materials (+41%).

·Only 29 stocks are up 25% or more. We won’t list this last batch, but

you get the idea. Less than 6% of the S&P 500 is up 25% or more.

Conversely, 74 names (15% of the index) in the S&P 500 are down 25% or

more.

Now, the year isn’t

over, and that’s the most important point of this exercise. With just 3 months left on

the calendar, many investors are down on the year for the reason we’ve outlined

here: nothing is really working. That leaves them only a short period to

show a positive return, or at least a less-negative result than whatever index they

track. To do that, many will have to make very specific and concentrated bets.

It might be about equities generally – will they recover from the current

growth scare? Or it might be asset allocation – will bonds finally go up

on the year? For stock pickers, the key question is certainly “Play the

winners, or look for laggards?”

All we know is that

with 69 days left to play catchup, time favors the fleet. And the bold.