Overview and Technical View:

The S&P has been consolidating since the December 13th high of 2,277 and has hung around the 2,270 level for several weeks now.

After the big surge off the November low (9.3%) and the presidential election the index has decided to take a breather. This has allowed some excessive overbought readings (rsi, stochastics, mcclellan) to be worked off. And as the market got extended during the post-election rally, momentum in the form of breadth exhausted itself which caused the slowdown in price movement.

Yet this week we've started to see a resumption of breadth and momentum in a number of readings. On January 4th the number of stocks up 4% flashed the highest reading since November 11th. Couple that with multiple 80%+ days on NYSE Advancing Volume Ratio and we see some credibility that the market may be poised for another leg higher.

We're not much for putting price targets on markets but looking at Fibonacci extensions from the two years of congestion that the S&P is emerging gives us a soft target of 2350 at the the 161.8 extension level.

Index's and Sectors

- From an index and sector view the technical picture looks positive. All 10 major S&P sectors reside above their 50-day moving average joining the four major domestic index's. Globally 6 of 9 major non-US markets are above their respective 50 day moving average.

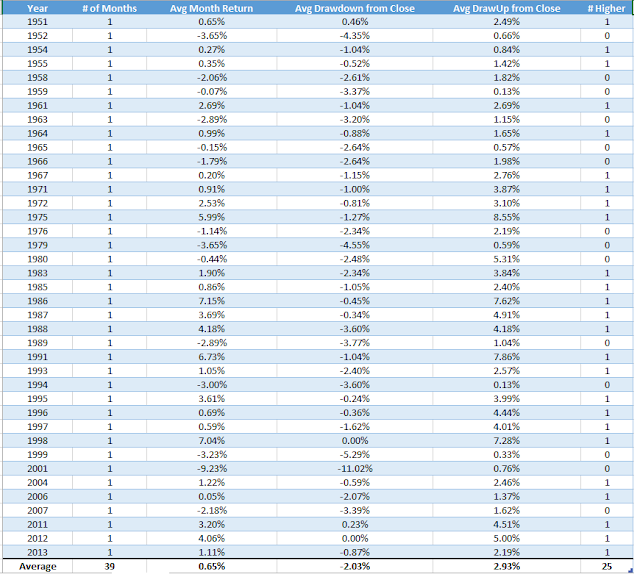

- From a seasonality standpoint January has averaged a loss of -.03% over the last 20 years. This would put it in 8th place versus all other months. The average daily trend of the S&P 500 over the last 20 years shows the typical peak coming in the first week of January.

Sentiment and Volatility

- AAII bullish sentiment at 46.2% was the highest reading since November 23rd. This marks the 8th consecutive week above 40%.

- The CNN Fear and Greed Index stands at 67 flashing a Greed Signal however it is down from an Extreme Green reading of 83 one month ago.

- The VIX is at 11.10 and has started the first week of the year down 20%

Leadership:

Banks have been the leaders of this market and continue to be on solid footing. The group as a whole remains extended while digesting gains from November. A look at GS tells the story.

Infrastructure plays (steel, chemicals, materials) are right behind banks in leadership. Some have pulled back and could be setting up for another run higher.

Yesterday brought some rotation into FANG and growth stocks that have lagged the current leadership but are slowly emerging as a few rallied above their 50 day moving averages on volume the last few days. NFLX remains the leader in the FANG group as that is testing all-time highs.