Well it didn't take long for volatility to pick up. On the first trading day after a long holiday weekend we're seeing deep red across the board. Volatility in the form of the CBOE Volatility Index (VIX) is up over 15% and all the major domestic stock indexes are down around 1%.

Underneath the surface there continues to be some major moves in macro assets. The Euro is heading south again after a brief relief rally and the Yen is breaking new lows from a 6-month consolidation. The beneficiary continues to be the dollar as that is surging and now back above its 50-day moving average. Meanwhile, oil is getting hammered lower as gold and silver sell off as well. In a rotation to safety, bonds are having a nice rally to the upside.

From previous posts and numerous studies, we know that a low VIX coupled with an extended market has not been a good combination in terms of short-term upside potential for stocks. This once again proved true (at least for a day) as volatility has spiked and the S&P is reverting back into its range. We'll be looking for clues to see if buyers have dried up or if fresh new selling/supply is coming into the market. Added developments here could mean fresh new lows for the market.

Additionally, after today we had more 52 week lows than highs across all US exchanges which is interesting considering the S&P hit a new high last week.

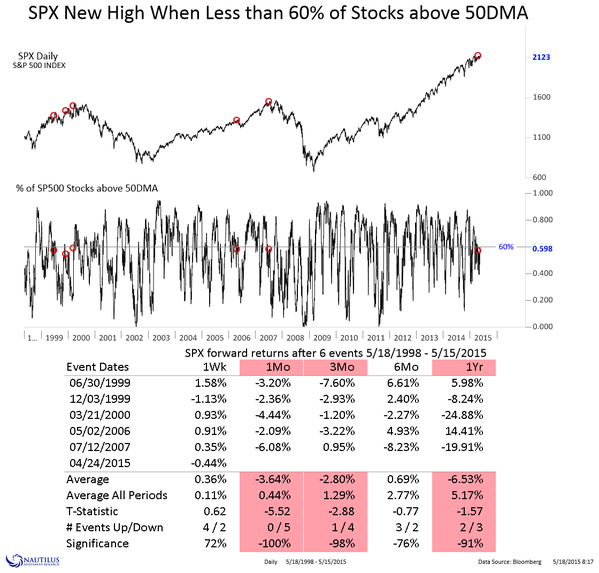

A recent tweet from Nautilus Research sums up the divergence in breadth and the unfavorable returns going forward. Is the deteriorating breadth finally catching up to this market or is it more of the same chop and slop?