We have reached the half way point for the calendar year and wanted to take the opportunity to review the report card from a performance stance. We like to start from the top down and then drill into some sector work. This will gives us a good idea of what is leading and lagging and some of the themes associated that has driven returns.

With that said, lets take a look at a performance map from the first half. A great resource that does this in a concise manner is

finviz. Below are some observations:

- US markets are the clear leader versus international developed markets.

- US small caps outperforming large caps.

- Emerging markets are lagging with Brazil and China dragging on performance.

- Fixed income has not been a safe haven to park cash.

- Commodities are a mixed bag with oil leading the pack higher.

- US dollar is the strongest developed currency.

- Volatility has perked up versus last years doldrums.

- Retail, biotech, technology, and oil and gas producers are the first half winners.

- Industrials, consumer staples, and financials are the first half losers.

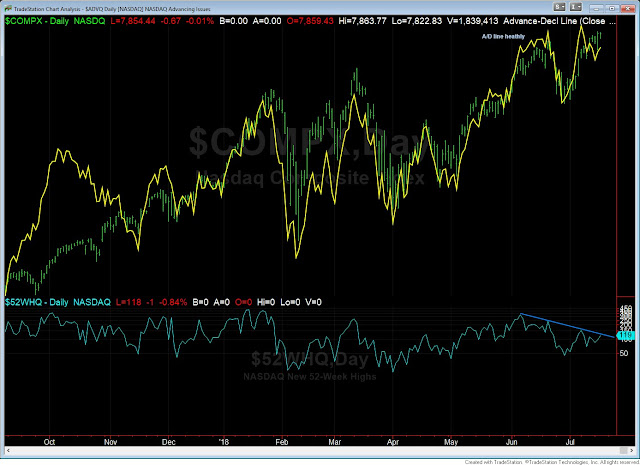

It has been a hectic first half of 2018 compared to the quiet trending markets last year. After a blistering start to the year when the S&P gained 5.6% in January the S&P experienced its first 10% pullback since February 2016. The S&P dropped 12% and 9% in the first half while the VIX index more than doubled. However, after all the volatility the S&P produced a modest gain on the year and is clearly outperforming international and emerging markets. With all the talk of trade wars, it seems the US is winning the war of words strictly on a performance basis. A simple ratio chart comparing the S&P 500 to the Dow Jones Shanghai index reveals the relative performance of the US vs. China.

One area of weakness that has piqued our interest and something we'll continue to monitor is the action in the Dow and NYSE index. Both indices have been the worst performers of the 5 major US domestic indices as they both have produced losses for the first half. Both are sitting on trend-line support that goes back 2 years. If these levels break it could warrant further downside especially as we enter the heart of the summer doldrums as liquidity dries up and can generate erratic price action.

When we drill down to sectors there are clearly some surprises that pundits didn't see coming at the beginning of the year. Most forecasts saw rising rates bullish for banks and financials. However, instead of a steeping yield curve it has narrowed putting pressure on the banking sector. The one bright spot has been regional banks within financials. Tech remains one of the leaders but maybe the biggest shock year-to-date is the emergence of retail as a leadership group. Most talking heads had brick and mortar left for dead as Amazon takes over the world. One interesting trend we follow is the ratio chart comparing high beta to low volatility. High beta stocks have been outperforming since 2016. However, momentum has been sucked out of high beta names over the last few weeks as this ratio is testing the lower trend-line. Are we about to see a rotation into more stable lower volatility names? This is definitely worth watching.

Going further into the micro level if we look at what July has to offer from a historical perspective there is not much to gain. July ranks right in the middle of the pack for average monthly gains over the last 20 years as it manages to eke out a small profit of 0.37%. The daily monthly trend shows that gains peak in the middle of month and fade towards the end of the month. One bit of good news from a contrarian perspective is sentiment remains very low as expectations have drastically come in the last few months.

The first half of 2018 certainly felt different than the easy trading environment of last year. As the markets continue to find its footing there are some pitfalls and themes over the next 6 months that could heighten volatility. These include:

- Geopolitics

- November elections

- Trade and tariffs

- Italy's political challenges and banking system

- Fed and rate increases

- China's devaluation

- Valuations, debts, and deficits

Following the performance trends give us a glimpse of the winners and

losers and where money is flowing. It also proves that following

conventional wisdom isn't always the best strategy. Looking outside the

box can unearth sizable opportunities where the obvious might be

wrong. While the market climbs the proverbial wall of worry, we observe the data and trends to guide our decision making process. The one theme that dominates is the relative strength of US domestic instruments. Couple that with the strongest developed economy keeps us in the bullish camp on US equities. 2018 has proven it won't be easy and there remains plenty apprehension, yet we continue to favor buying equities into weakness and riding the current momentum.

Have a wonderful and safe 4th of July!