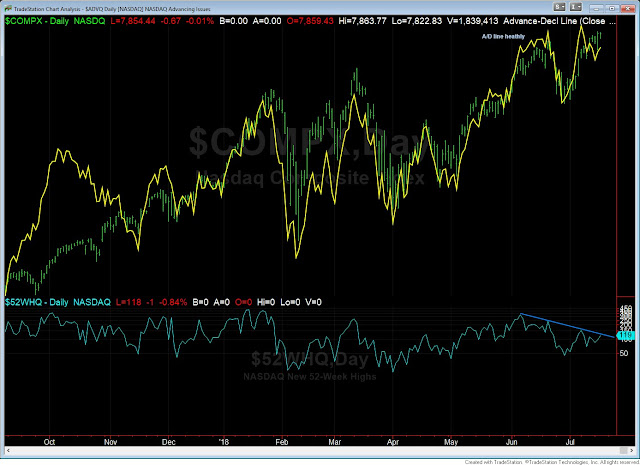

Price action remains bullish as the Nasdaq is at highs and small/mid caps are within spitting distance of new highs. The S&P is above the 2800 resistance level as the NYSE and Dow remain in consolidations. It is a good exercise to look under the hood to see what is driving the indices and see if we can gain any insight. The one thing that worries us is the lack of breadth has not followed price action higher. The overall Advance/Decline line in the Nasdaq and S&P remains bullish yet some more subtle shorter-term breadth figures paint a different story. Below are some of the breadth indicators showing negative divergence:

- Nasdaq new 52 week highs

- Nasdaq % of stocks above 50 and 200 day moving average

- S&P new 52 week highs

- S&P % of stocks above 50 and 200 day moving average

For the indices to maintain new highs or recent strength they will need to have broad participation to follow though to the upside. With the VIX at complacent levels it won't take much to spook the market especially with thin leadership. This will be something to watch over the next few weeks as a plethora of earnings are released. Will participation escort price to new highs or will price succumb to a lack of leadership and retreat?