China's devaluation

Trade war

HK protests

China debt issues

Yield curve inversion

Potential for recession

Slowing growth

Negative yields across the world

Gold spiking

The one thing that worries us the most, is the confrontation between China and HK. If the PLA invades to quell the protests this could turn into a global event and the potential black swan for the markets. According to Henrietta Treyz at Veda Partners this is going to be our modern day Tiananmen Square. "Meanwhile, it continues to be the view of the Republican caucus and some on the Street that the ongoing Hong Kong protests and paramilitary escalation will require a robust response from both the United States and increasingly Japan based on our conversations in the last 48 hours, both in terms of economic sanctions and public outcry. There is a general sense amongst trade counsel on the Hill, particularly from within the Republican caucus (where we spend a good deal of our time considering their votes would be necessary to advance any tariff-stripping authority in the US Senate) that escalation to the scale and scope of Tiananmen Square 30 years ago is more likely than not."

Currently all this angst have driven sentiment heavily bearish and only after a 6-7% drop. This leads us to believe that the news media has created more hysteria than reality. If we look at the recent BAML fund managers survey it can give us a good read into sentiment and positioning.

Below are the key takeaways from the monthly survey:

The BofAML August Global Fund Manager Survey

The nut: August BofAML FMS most bullish on rates since 2008 as trade war concerns send recession risk to 8-year high; investors slash exposure to cyclicals to buy US Treasuries & US growth stocks; with global policy stimuli at a 2.5-year low, onus is on Fed/ECB/PBoC to restore animal spirits.

On growth: 1/3 of FMS investors expect a global recession in the next 12 months, the highest since 2011.

On policy: FMS investors say global fiscal & monetary policy mix is the most hawkish since Nov'16; only 9% see higher bond yields in the next 12 months, the most bullish stance on rates since 2008.

On leverage: 1/2 of FMS investors say corporates are excessively leveraged, a new record; investors want corporates to use cash to improve balance sheets > capex or buybacks.

On risk appetite: in contrast to June, the FMS cash level did not surge as growth expectations plunged…August cash levels fell from 5.2% to 5.1%; BofAML Bull & Bear Indicator holds at3.7 (not extreme bearish though record net % say they have taken out protection).

On rotation: FMS investors sold cyclical value (Japan at 7-year low, industrials 2nd biggest MoM drop ever), bought defensives/growth (staples, tech) & bonds (#1 most crowded FMS trade = long US Treasuries); "growth over value" highest since GFC.

On US: FMS investors say US equities are the most preferred region over the next 12 months despite 78% saying the region is overvalued; note combination of two 2nd most extreme on record (#1 Aug'18).

On bubbles: FMS investors say biggest central bank-induced bubble risk in: #1 corporate bonds (33%), #2 Govt bonds (30%), #3 US equities (26%), #4 gold (8%).

FMS contrarian trades: contrarians should be long inflation vs. deflation assets (equities>bonds, Japan>US, industrials>pharma).

Below are three charts that sum up the fear among fund managers.

34% of FMS investors thing a recession is likely in the next 12 months which is the highest recession probability since October 2011.

The dominant concern of investors remains the ongoing trade war with China. Meanwhile the most crowded trade remains long US treasuries in a flight to safety as the Fed has started to now lower rates and global capital is flocking to US bonds.

The recent AAII survey saw pessimism spiked to its highest level and optimism plunged to its lowest level since December 2018. Bearish sentiment is now unusually high and bullish sentiment is unusually low.

The most recent CNN fear and greed indicator shows extreme fear.

The VIX term structure has inverted showing more fear and pessimism.

Now that we have touched on what investors are worried about and how that has affected sentiment lets look at how the charts are shaping up. The Dow, S&P, and Nasdaq remain in uptrends and well above their Dec. 18 lows. The one area of concerns is the Russell 2k which is making lower highs and lower lows since the 1st quarter.

A closer look at the Russell 2k shows a classic breakdown from a diamond pattern. Small caps have lagged all year and continue to do so.

What is interesting is the strength of the market this year has been on the back of growth. Growth has drastically outperformed value.

Yet, low volatility has outperformed high beta since last October and the ratio chart is making a new low.

On top of that Gold and Bonds are outperforming equities since July. Both remain extremely oversold and reside in their upper bollinger bands on the weekly charts. Historically, these are areas where a breather is needed.

With the data presented above you can certainly see why investors are nervous. We asked the question earlier if this was the beginning of a bear market. We really don't know but some stats below help the bulls case. A tweet by @PeterMallouk says "Over the last 40 years, when the U.S. yield curve inverted as it did today, the market was up 66% of the time 1 year later and 33% of the time 3 years later. Globally, the market is up 86% of the time 1 year later and 71% of the time 3 years later. Source: DFA"

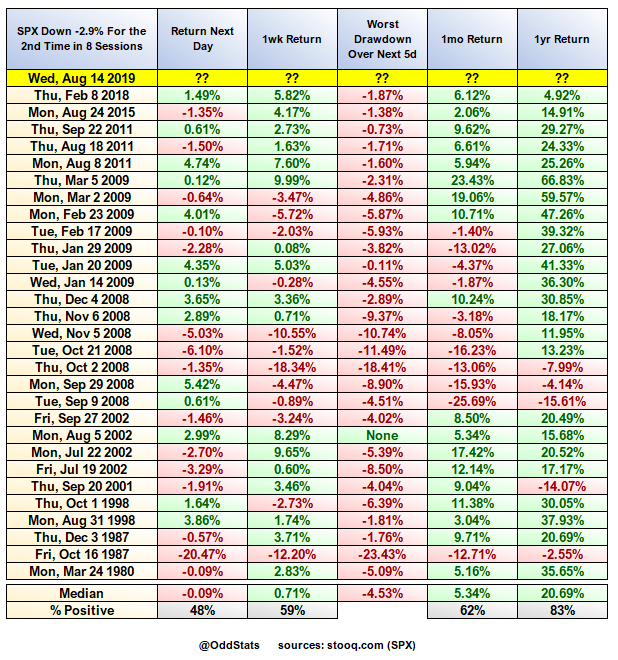

And after yesterday's plunge in the S&P you would think it spells trouble for the market. However, a study from OddStats shows "The S&P 500 $SPX just saw its second -2.9% day in 8 sessions.

Because you assume that means the market is collapsing to zero, here's every other time that's happened in the past 40 years.

Last 6 events, $SPX was sharply higher a week later."

On top of that allocations are heavily positioned for low growth/recession. When we assess the data and sentiment the market is ripe for a vicious short covering rally at some point. We don't believe we are entering a bear market but rather a correction within the ongoing secular bull. Are we subject to more downside first? Sure, but we still believe the market has a tailwind with an accommodating Fed and heading into an election year. There are times when it pays to be aggressive and times to raise some cash. We are buyers into weakness but will be prudent when picking our spots.