It has been a sensational run off the March lows considering we are still in the thick of a pandemic. The next few months have plenty of known unknowns that could create more volatility than the market has experienced in the last four months. Whether it is the upcoming election, geopolitical maneuvering with China, daily riots, or just the summer doldrums the market has plenty of news worthy items to answer over the next few months.

The current market looks and remains bullish as the S&P, Nasdaq, and Russell 2000 all remain above their upward sloping 50 day moving average and in a confirmed uptrend. The charts below speak for themselves as the last four months, off the March low, has been straight up and to the right. A classic sign of a trending market.

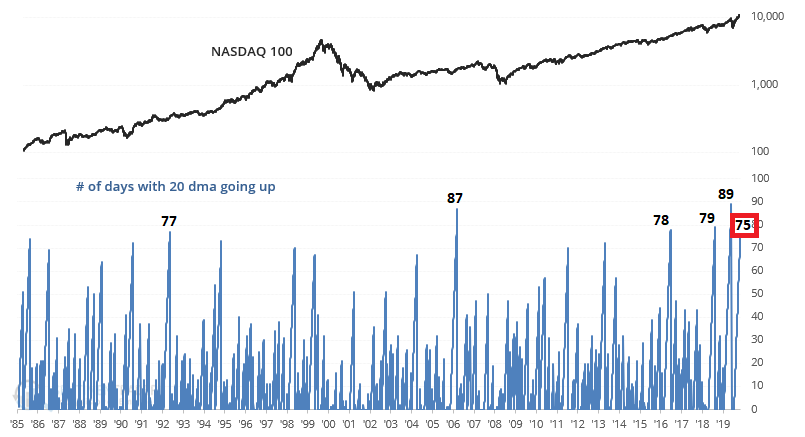

Sentiment trader lastest tweet shows the incredible persistent trend in the Nasdaq and how this usually ends in a pullback, as this is the 6th longest streak ever.

One area that has put us on watch is the weakening breadth. Most of this could be a product of 5 stocks now make up 20% of the S&P. Regardless, we prefer to see expanding breadth rather than a negative divergence. This can resolve to the upside but it is something to keep on your radar. Below we can see that the the percentage of stocks trading above their 50-day moving average is declining while both the S&P and Nasdaq continue to rally.

As we stated earlier the current market looks bullish. A recent note from the guys at Macro Ops points out that we are likely at the "As Good As It Gets" point with asset returns. The BofA all-weather portfolio (25% stocks, 25% bonds, 25% cash, 25% gold) has just seen its best 90-day returns in history. Another example that this market could be exhausted and ready to punish the greedy.

The weight of the evidence in the longer term suggest higher prices. We covered many of these in prior posts about strength begets strength. One interesting stat that provides a bullish case longer term is a study from Ciovacco Capital showing the massive exhaustion in the VIX and how this is actually positive.

We remain bullish long term as we believe the market is in a secular bull. Considering the new rounds of stimulus and rates at historically low levels this should bode well for the bull thesis. But that doesn't mean the market could be ready to take a pause and the evidence in the short term could support that. As we enter the heart of earnings season we'll be looking to see if the trend can remain up or does the weakening breadth ultimately catch up to prices and the market enters a period of chop and potential draw down. We attempt to be prepared for any scenario and ultimately price will determine who is right.