Up to and for a short time after the Federal Reserve's meeting on 9/17, the S&P 500 had rallied 3% from last Friday's closing level of 1,961. However, once Janet Yellen announced that she would not be raising short-term interest rates, the market once again went into flux as it sought to digest the news. Stocks rallied for about an hour after the 2pm Fed announcement but from there on it was all downside for the S&P. From roughly 3pm Thursday to Friday's close, the index fell more than 3% to settle barely in the red for the week.

We're still of the mind that stocks will need some time to recover from the recent spike in volatility and the late August correction. We expect volatility to remain elevated and should see some big moves in either direction.

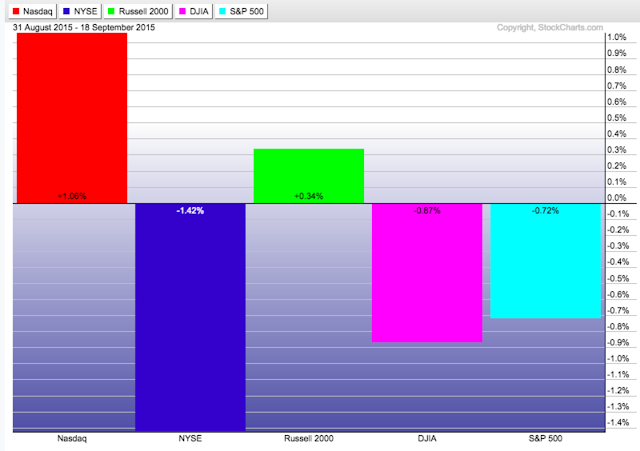

Here's how index performance looks on more extended timeframes:

Month-to-Date:

Quarter-to-Date:

Year-to-Date