A few weeks back, one could have argued that several breadth indicators were suggesting that the market was being pulled higher by particularly narrow leadership. However, in recent days/weeks, we've seen an increase in participation and individual stocks showing strength.

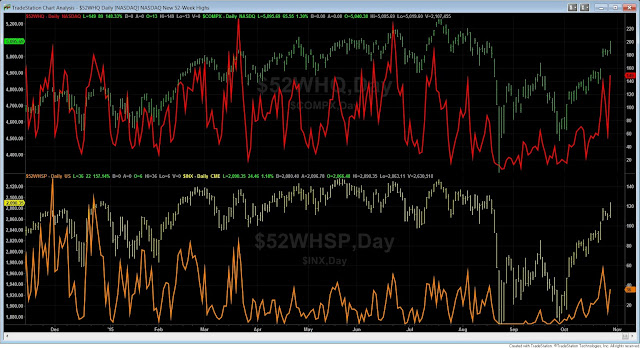

For starters, we've seen a nice move in new 52-week highs in the Nasdaq. In the chart below, the red line serves as the new 52-week high indicator and as you can see, the measure has kept pace with the Nasdaq's advance. What this means is that a collection of stocks have helped to pull the index higher by advancing to yearly highs.

The bottom of the chart shows the same comparison for the S&P 500 which has yet to be accompanied by such strength.

Other measures we watch also suggest that breadth is strengthening. We're seeing a strong breakout in stocks making 20-day highs along with a healthy rise in the % of stocks above their 10, 20, and 50-day moving averages.

On the flipside, one data point that bears watching is the Nasdaq and the negative divergence currently in place with its Advance/Decline line. As the index has shot back toward its highs, the A/D line remains stuck in a downtrend and has not confirmed the recent price highs. Ideally, you'd like to see this line rising in stride with price as it would be suggesting that the majority of stocks in the index are participating. With the index being cap weighted, it has staged this rally on the backs of some of its premier names, Microsoft, Google and Amazon, to name a few.

Breadth has certainly improved in recent weeks and we're seeing increasing signs of this being a healthy rally. We may be a little overheated here in the short-term but nothing a small pause wouldn't relieve.