Stocks logged their 4th straight week of gains as the major indexes saw impressive gains on Thursday and Friday. The combination of strong tech stock earnings reports (Microsoft, Google, & Amazon), a surprise interest rate cut out of The People's Bank of China and European Central Bank President, Mario Draghi, hinting that more quantitative easing measures were on the way for the Eurozone.

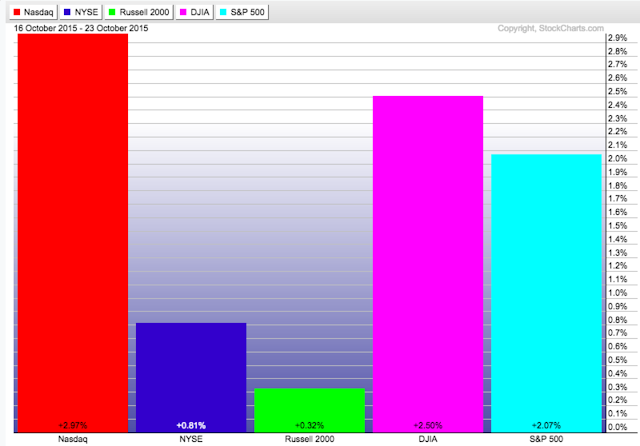

When the Friday closing bell sounded, the S&P 500 had gained 2.1% for the week while the Dow and Nasdaq gained 2.5% and 3%, respectively.

The week's strong gains were enough to propel the S&P back into positive territory for the year and the month of October is shaping up to be one for the record books. The S&P is now up 8.08% for the month and if things were to stay as they are, it would be the 6th best October ever according to Ryan Detrick.

So with that said it should come as no surprise that it's been a banner month for all of the major US equity benchmarks with the Nasdaq leading the way.

Stretching the lens out to a year-to-date view, we see the Nasdaq, again, is the clear leader. Meanwhile, the Russell 2000 (small caps) and the Dow remain negative on the year.

Overseas markets have seen powerful rallies in October as well. As mentioned above, serious talk of further QE action in Europe has propelled those markets higher while Japan continues to be a pocket of strength on a relative basis.

On Wednesday morning, we covered what we thought to be some of the more relevant bull and bear data points at this point in the market. After weighing the evidence, we argued that a slight bullish bias might be warranted through year-end and after 3 days, we look like geniuses! Unfortunately, we'll hold off on the celebration until the book is closed on 2015. Taking a much shorter-term view, the market does appear to be a little overheated here. This chart from Raymond James shows that the S&P is now the furthest above its 50-day MA since last December and it may be wise to exercise some caution here in the near-term.

This makes some sense now that the index has rallied just about 11% since the end of September. Digging deeper into the market, nearly every sector group has fully participated in this rally. Looking at the S&P domestic sector etfs we see that only Health Care and Utilities have truly lagged behind. As mentioned, Tech has been incredibly strong while Energy is finally getting a bid as well.