The S&P 500 logged its 6th straight weekly gain and the Dow Jones Industrial Average moved back into positive territory for the year as stocks continued their bounce off the September lows.

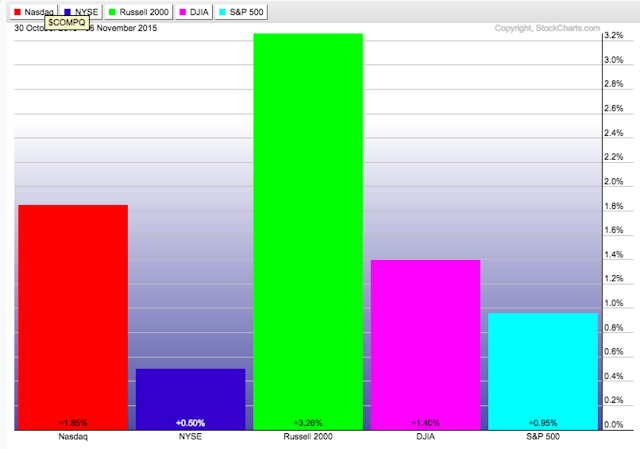

Small Cap stocks (Russell 2000) enjoyed an incredibly strong week that left the index 3.3% higher by Friday's close. The strength in small caps helped to alleviate some of the recent concerns over their lagging behavior. Meanwhile, the S&P was up 1% and the Nasdaq continued to impress with another 1.9% of gains.

The Nasdaq continues to be the clear leader on a year-to-date basis and now stands 8.7% higher in 2015. The S&P is now up 2% YTD and, after its big week, the Russell 2000 is just barely negative at -0.4%.

While the S&P was largely unchanged on Friday, the strong monthly jobs report appears to have boosted the expectation of the Federal Reserve lifting rates at its December meeting. We'll see if that expectation continues to hold over the course of the next month and how the market reacts.

On a sector basis, Energy and Financials carried the market higher as they each gained more than 2.5% during the week.

On Thursday, we wrote about the market entering an area where it was likely to face plenty of resistance as it sought to log new highs. The 2,135 to 2,150 region on the S&P may take some time to conquer but with the index now back above its 12-month moving average it bodes well for higher prices going forward.

Looking toward year-end, we thought this 2011 vs 2015 comparison by Ryan Detrick was, if nothing else, a pretty thoughtful exercise. It will be interesting to see if 2015 continues to bear a resemblance.