As mentioned in our first post, we're big believers in the KISS philosophy. Keep It Simple Stupid. Within that framework, we are in constant search of the most relevant information available to both support and, more importantly, challenge our investment decisions.

We look at a ton of data. And we can look at it until we're blue in the face but quite frankly unless we're processing that data properly and fairly, we run the risk of using it to confirm any biases we may be carrying. It's impossible to have a perfect record in this regard but it's something we constantly challenge each other to manage.

The massive divergences taking place in the markets have brought about a flood of charts and articles across our desks lately. Concerns over breadth and leadership seem to have everyone positioned with one foot already out the door. One of our favorite resources, Dr. Brett Steenbarger's Traderfeed blog, touched on this topic on Wednesday (Breadth Weakening) and one could certainly allow the story told in these data points to dictate the posture of their portfolio.

Yet for all the negative divergence warnings we've been seeing, here's one we see as a potential major positive. After some recent periods of weakness are financials about to lead the market? Over the last month the strongest sectors have been brokers, banks, regional banks, and financials (chart by Telechart). The relative strength of the XLF vs the S&P 500 is breaking out to 3-month highs.

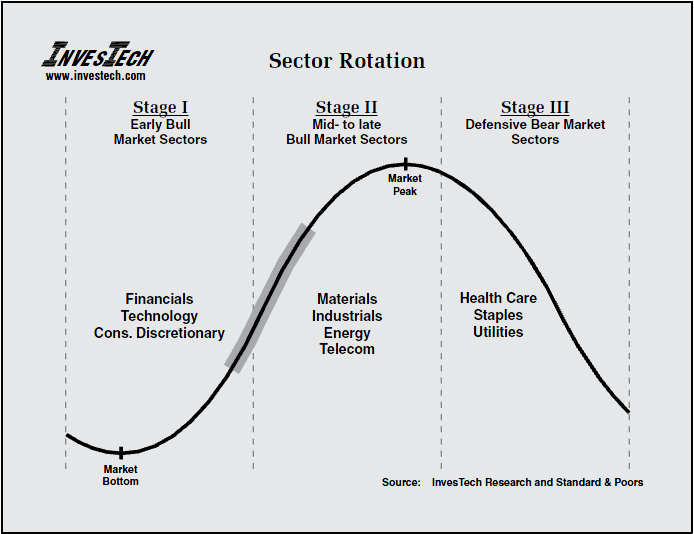

This is in conjunction with the rise in yields. We'll be watching this action closely as money appears to be aggressively rotating into these sectors. To make things even more confusing, Financials leadership has historically been more characteristic of an early stage bull.

As always, the market seems far more interested in making us look stupid rather than helping us keep it simple....