Research from Lowry's states "The Advance-Decline Line has been a very important tool in measuring the forces of Supply and Demand at work in the stock markets for more than 80 years. In fact, of the fifteen major bear markets (defined as those generating losses of -20% or more) occurring in the 80 years between September 1929 and March 2009, thirteen of the fifteen cases (86.7%) were preceded by several months of significant negative divergence between the Dow Jones Industrial Average and the NYSE Advance-Decline."

The challenge with this type of research is that only in hindsight does it make perfect sense. In real-time, however, it becomes an entirely different exercise. Case in point take the take the 1973 top in the DOW in which the market then tumbled close to 47% until the December 1974 bottom. The A-D line topped out in mid-1971, just about a year and a half before the Dow put in its high.

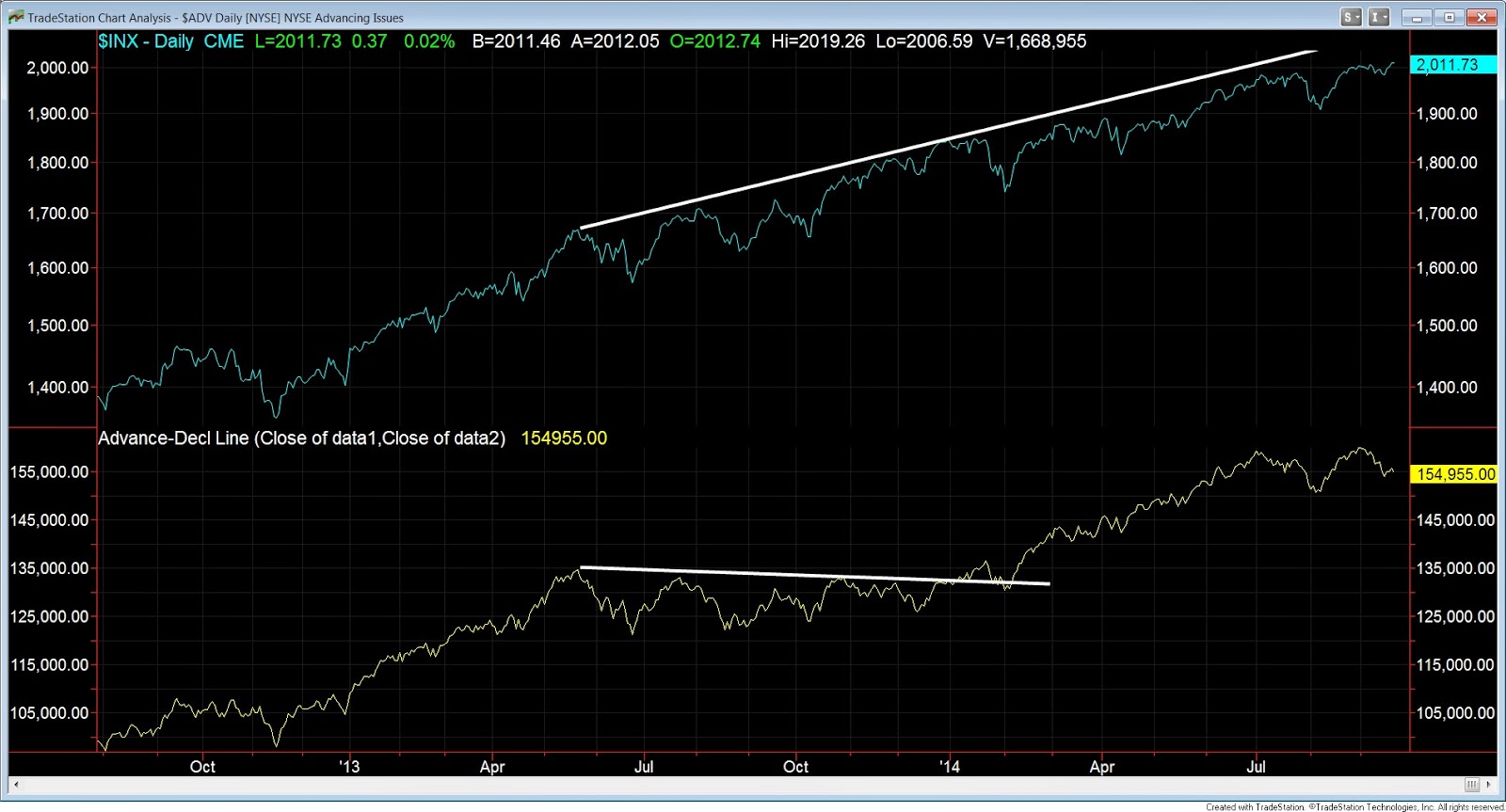

Based on the numbers a negative divergence in the AD line gives a high probability of a market top (86.7%). However breadth divergences can just as easily resolve to the upside. A good example is the recent action in the S&P. We had a divergence in the A-D line vs price highs in the S&P for over 6 months (6/13-1/14). However, the S&P never corrected and the A-D line eventually made new highs along with the general markets.

|

| Charts from Tradestation |

What is difficult is trying to use this data as a timing device as divergences between breadth and price can last months and in some cases years. However it doesn't mean they are useless. Its just part of the process to shape the direction of the market and keep the possibility of a top in mind.....

What is useful to know is that almost 87% of all major tops have showed this divergence. So if and when we do get a top perhaps this will have been one of the market's "tells". Along those lines, the Nasdaq is currently showing a major divergence. Only time will tell.