We're big believers in agenda-free investing. It's important that investors be aware of their biases and avoid "forcing" trades because of them. When we look at data and trends, we're hoping to determine the potential scenarios the market is offering us while not becoming married to any single prediction/outcome. Yet from those scenarios, we believe we can make more informed decisions and better define our risk when making our next directional trade.

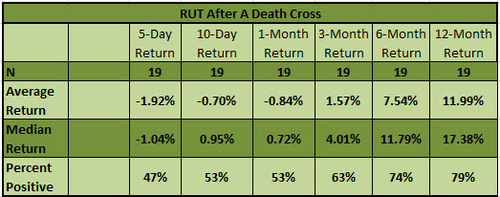

With all the talk on divergences and death crosses, I wanted to touch on the recent weakness in the Russell 2k and some observations. The death cross (50 day moving average crossing below the 200 day moving average) that is happening in the IWM lacks a clear historical edge to the downside. This can be seen with the useful study shown below (from Ryan Detrick Russell 2k Death Cross). We can see that while near-term returns skew to the downside, intermediate (3-month to 1-year) performance is meaningfully positive the majority of the time.

However, what worries us is the clear divergence between small caps and large caps. The folks at Nautilus Research (@NautilusCap) help sum this up with the data shown below. It looks at the instances where the S&P has proceeded to climb (up > 5% in a 6 month period) while the Russell is retreating on a relative basis (RTY/SPX Declines > 10% over the same 6 month period). To summarize, the data portends to the Russell and the S&P struggling over the next couple of months and considerably underperforming relative to their historical trajectories.

Lastly, in our quest to keep it simple, a long term price chart of the IWM is what concerns us most. If this long term up trend-line breaks to the downside we could be in for more pain and a much larger correction. Since the beginning of the bull market in 2009, this trend-line had only been touched twice prior to this year (October 2011), (November 2012). In 2014 alone we have tested this significant support 3 times. This is something we are watching closely and its resolution will assist in understanding the scenarios the market is currently offering.